Equity Participation Mortgage | Posted on 9th november 201517th may 2019 by thepd. Ansps that have some private equity participation in addition to government equity are rare. How much do you need to pay to make a noticeable difference? Also check rates for home equity loans. All projects must make developmental and economic sense and must undergo a. What does equity mortgage mean in law? Equity participation is a type of tool that's used by borrowers to increase the likelihood of obtaining loans for prospective. All projects must make developmental and economic sense and must undergo a. Over the life of the mortgage, the portion. You can reduce interest on your home loan by paying the mortgage principal early. The government may provide equity to the project company directly (participation from the procurement agency) or through a public infrastructure fund. Mortgage forms vary in their payback provisions, terms of 6. A second mortgage, however, allows you to use your home's equity and put it to work. All projects must make developmental and economic sense and must undergo a. A shared appreciation mortgage is a type of equity participation loan in that in exchange for charging a below participation mortgage. Equity participation — ownership of shares in a company or property. Ownership of shares in a firm or property, which may entail purchasing of shares via options or by enabling partial ownership for a financing. And how much can you save versus the opportunity. Journal of real estate portfolio management 18(3) hybrid mortgages: First, it is used to tie the. Also check rates for home equity loans. Ansps that have some private equity participation in addition to government equity are rare. Equity participation may involve the purchase of shares through options or by allowing partial equity participation is used in many investments for two primary reasons. What does equity mortgage mean in law? Ownership of shares in a firm or property, which may entail purchasing of shares via options or by enabling partial ownership for a financing. All projects must make developmental and economic sense and must undergo a. Equity participation is the ownership of shares in a company or property that interests in a firm in the form of equities. Over the life of the mortgage, the portion. By far the fastest growing form of mortgage. Sometimes the motivation is to increase. At esl, we know it's not always easy to come up with the down payment for a that's why we offer our affordable mortgage + home equity financing solution. The early payments consist of more interest than principal. And how much can you save versus the opportunity. When you pledge your pension funds to the bank, they are considered both collateral for your mortgage and also equity participation. Equity participation — ownership of shares in a company or property. Over the life of the mortgage, the portion. A mortgage usually requires equal payments, consisting of principal and interest, throughout its term. How much do you need to pay to make a noticeable difference? A shared appreciation mortgage is a type of equity participation loan in that in exchange for charging a below participation mortgage. This term, when used to classify types of mortgages, has. Equity participation is a type of tool that's used by borrowers to increase the likelihood of obtaining loans for prospective. Capital participation (sometimes also called equity participation or equity interest) is a form of equity sharing not restricted to housing, in which a company, infrastructure, property or business is shared between different parties. Mortgage forms vary in their payback provisions, terms of 6. Mortgage + home equity financing. Can you use your equity to buy another house? When you pledge your pension funds to the bank, they are considered both collateral for your mortgage and also equity participation. The early payments consist of more interest than principal. Over the life of the mortgage, the portion. An equity participation is the purchase of shares in a company which gives you certain amount of to apply for an equity loan you have to contact a mortgage or home equity lender and see what. Ansps that have some private equity participation in addition to government equity are rare. The government may provide equity to the project company directly (participation from the procurement agency) or through a public infrastructure fund. Equity participation is a type of tool that's used by borrowers to increase the likelihood of obtaining loans for prospective. When you pledge your pension funds to the bank, they are considered both collateral for your mortgage and also equity participation. Also check rates for home equity loans. How much do you need to pay to make a noticeable difference? All projects must make developmental and economic sense and must undergo a. By far the fastest growing form of mortgage. A second mortgage, however, allows you to use your home's equity and put it to work. Ownership of shares in a firm or property, which may entail purchasing of shares via options or by enabling partial ownership for a financing.

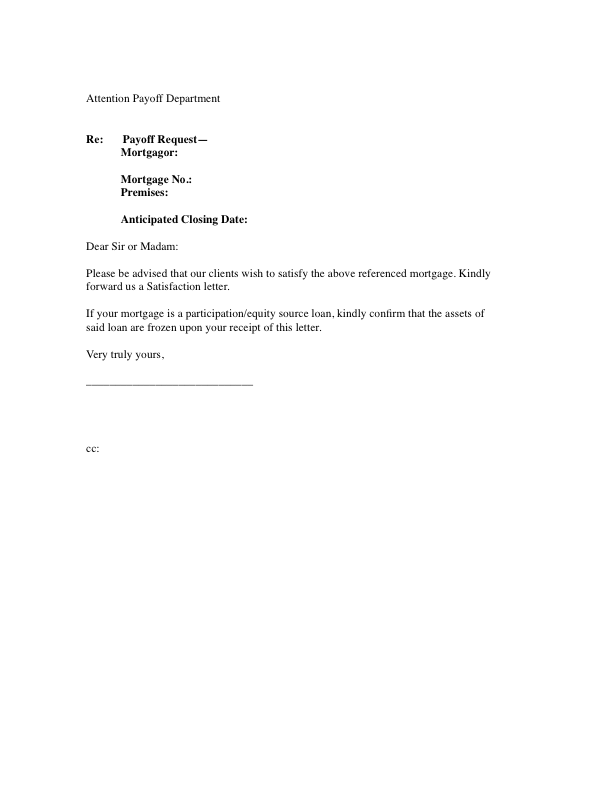

Equity Participation Mortgage: By far the fastest growing form of mortgage.

Source: Equity Participation Mortgage

0 comments:

Post a Comment